The Best Guide To Eb5 Investment Immigration

The Best Guide To Eb5 Investment Immigration

Blog Article

An Unbiased View of Eb5 Investment Immigration

Table of ContentsIndicators on Eb5 Investment Immigration You Need To KnowLittle Known Facts About Eb5 Investment Immigration.Eb5 Investment Immigration - An OverviewWhat Does Eb5 Investment Immigration Mean?The Ultimate Guide To Eb5 Investment Immigration

While we aim to provide precise and updated content, it ought to not be considered legal suggestions. Migration legislations and laws go through alter, and private conditions can vary widely. For customized guidance and lawful guidance concerning your certain immigration circumstance, we highly suggest talking to a certified immigration attorney that can supply you with tailored help and guarantee conformity with present regulations and laws.

Citizenship, through financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Rural Locations) and $1,050,000 in other places (non-TEA zones). Congress has accepted these quantities for the next 5 years beginning March 15, 2022.

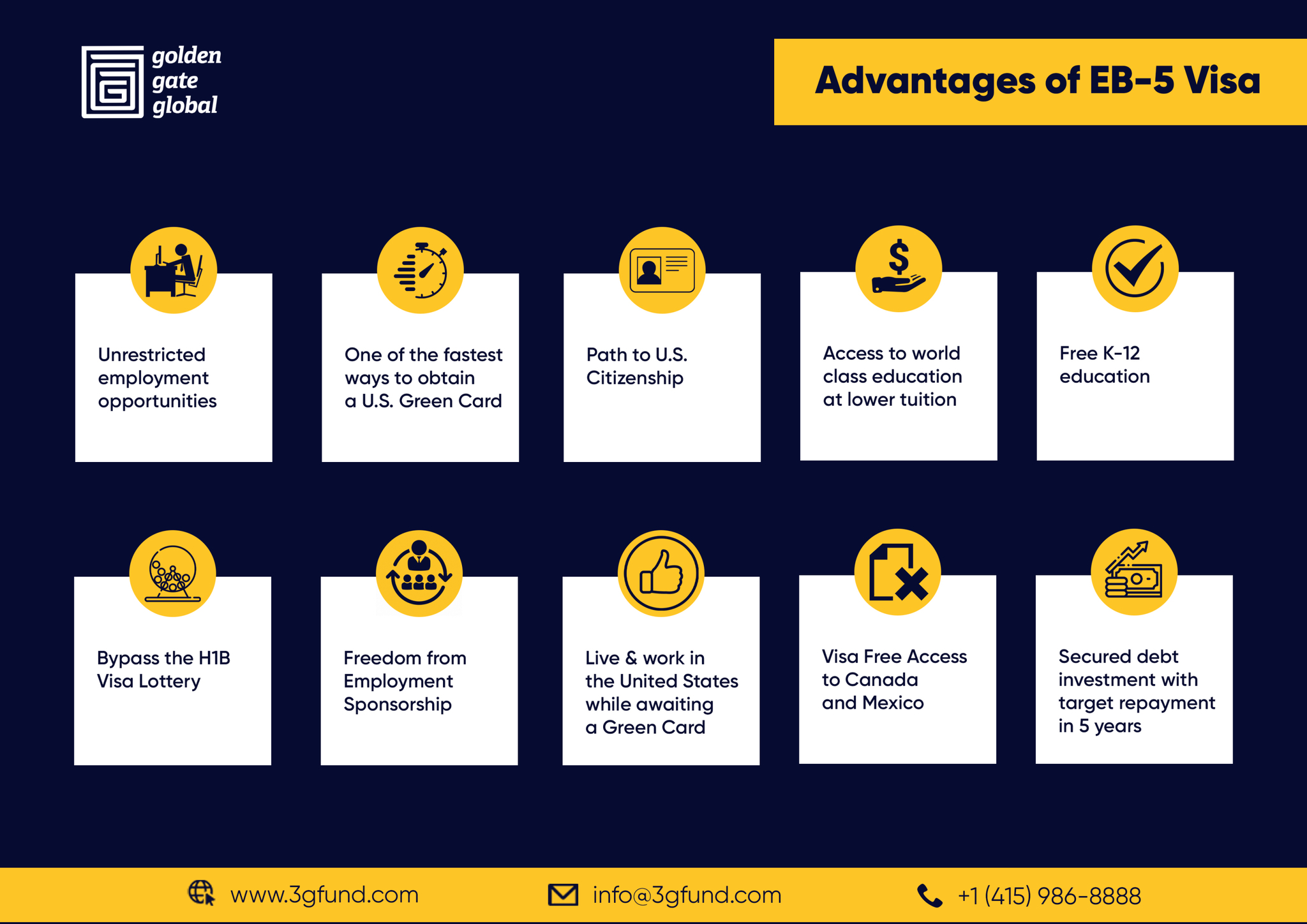

To receive the EB-5 Visa, Investors need to create 10 full time U.S. jobs within two years from the date of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement makes sure that financial investments contribute directly to the U.S. task market. This uses whether the work are produced directly by the commercial enterprise or indirectly under sponsorship of a designated EB-5 Regional Facility like EB5 United

Eb5 Investment Immigration Can Be Fun For Anyone

These tasks are figured out through designs that use inputs such as advancement expenses (e.g., construction and equipment costs) or annual incomes created by ongoing procedures. On the other hand, under the standalone, or straight, EB-5 Program, only straight, full time W-2 worker settings within the commercial venture might be counted. An essential risk of counting only on direct employees is that team reductions due to market problems might result in not enough full time positions, possibly bring about USCIS denial of the financier's petition if the job development demand is not met.

The financial version then forecasts the variety of direct tasks the brand-new company is most likely to create based upon its expected incomes. Indirect tasks computed via economic models describes work produced in industries that supply the goods or services to the business straight associated with the project. These work are produced as a result of the enhanced demand for items, materials, or services that sustain the service's operations.

Eb5 Investment Immigration for Beginners

An employment-based fifth preference category (EB-5) financial investment visa offers an approach of ending up being a long-term united state homeowner for international nationals wanting to spend capital in the USA. In order to get this permit, a foreign financier needs to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Area") and create or protect at the very least 10 permanent jobs for USA workers (leaving out the investor and their immediate household).

This action has been an incredible success. Today, 95% of all EB-5 funding is raised and spent by Regional Centers. Because the 2008 financial situation, access to capital has actually been constricted my review here and metropolitan spending plans continue to face considerable shortages. In several regions, EB-5 investments have actually filled up the funding void, providing a new, important source of funding for local economic advancement jobs that resource renew areas, develop and sustain jobs, infrastructure, and services.

7 Easy Facts About Eb5 Investment Immigration Described

employees. Additionally, the Congressional Spending Plan Office (CBO) racked up the program as profits neutral, with administrative prices paid for by applicant charges. EB5 Investment Immigration. More than 25 countries, consisting of Australia and the United Kingdom, usage similar programs to bring in international investments. The American program is more rigorous than lots of others, requiring significant danger for investors in regards to both their financial investment and migration status.

Households and people who look for to transfer to the USA on a long-term basis can make an application for the EB-5 Immigrant Financier Program. The USA Citizenship and Immigration Solutions (U.S.C.I.S.) set out different requirements to get long-term residency via the EB-5 visa program. The demands can be summarized as: The capitalist should fulfill capital financial investment amount needs; it is normally required to make either a $800,000 or $1,050,000 funding investment quantity into a UNITED STATE

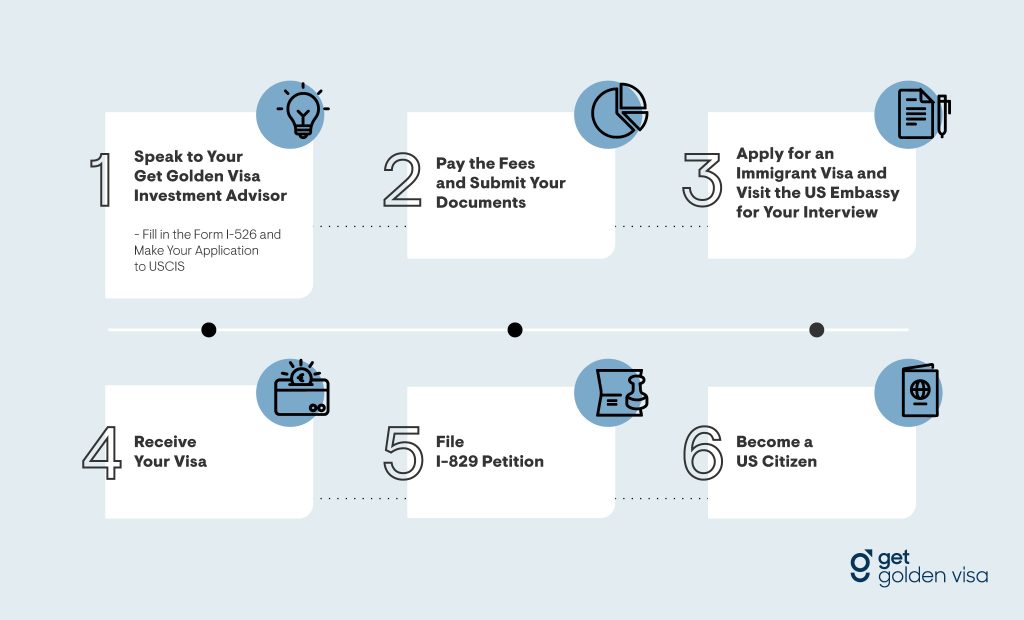

Speak with a Boston migration attorney concerning your needs. Right here are the basic steps to getting an EB-5 financier environment-friendly card: The very first step is to find a qualifying investment possibility. This can be a new company, a regional center task, or an existing business that will certainly be increased or restructured.

Once the opportunity has been identified, the investor must make the investment and submit an I-526 petition to the united state Citizenship and Migration Services (USCIS). This petition must consist of proof of the financial investment, such as financial institution statements, purchase agreements, and service plans. The USCIS will review the I-526 request and either accept it or demand extra evidence.

Eb5 Investment Immigration Things To Know Before You Get This

The financier must make an application for conditional residency by submitting an I-485 application. This request the original source has to be sent within six months of the I-526 authorization and need to include proof that the investment was made which it has produced at least 10 full time jobs for united state workers. The USCIS will assess the I-485 request and either accept it or demand additional evidence.

Report this page